Technopreneurship - Potential Pitfalls

Some entrepreneurs become complacent and rest on their laurels once they are successful. They do not bother to shift roles to meet new challenges that surface every now and then in the New Economy. Then there are others who, fueled by dreams of even greater wealth and success, are over-ambitious, reckless and greedy. They go on investment stampedes to make quick money as was the case during the dot.com frenzy. The dot.com bomb expose some CEOs who, instead of building shareholder value, were building personal value. They sang the song venture capitalists loved to hear and business plans were written to tap that $50 million instead of the $5 million in revenues. They treated shareholders like pastries instead of parties to whom they had a moral responsibility to protect and serve. Once the frenzy ended, the CEOs too were left with just a little bit more than they had begun with.

Then again there are those who let success go to their heads; they become vain and arrogant and succumb to excess.

The danger of developing a culture of complacency, reckless optimism, ambition and greed or vanity is very real. Entrepreneurs will do well to remember these five greatest pitfalls and avoid them.

1. Ego, arrogance and excesses,

2. Dwelling on the glory days,

3. Underestimating or overestimating your perceived value,

4. Subscribing to the "Build and They Shall Come" belief, and

5. The wrong business model.

Ego, Arrogance and Excuses

These have been known to fell many successful entrepreneurs. Some, with their newfound wealth, succumbed to excess and bought helicopters, jets, yachts, luxury apartments and mansions, all symbols of corporate excess.

Others were arrogant, spending an enormous amount of money on full-page newspaper advertisements when they knew very well that a reader's attention on a full-page advert is less than eight seconds. It was their arrogant way of telling other startups, "Hey we have got investors to back us, do not bother coming near us."

What they did not understand is that the more money one spends the more one has to recover before the business can become profitable. And haven't they heard, "Pride comes before a fall"?

Drawing On The Glory Days

It is not who we used to be but who we are that matters.

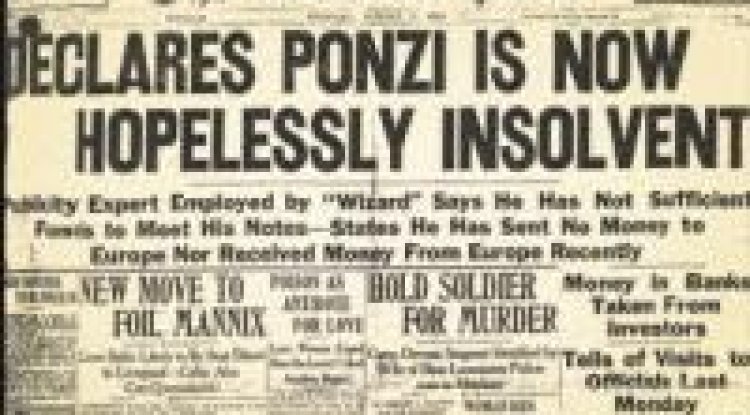

I know a once dynamic entrepreneur who at his peak was the biggest player in the stockbroking business. But with success comes greed and dishonesty. The meltdown of the market exposed him, destroyed his morale and left him with a mountain of debts.

This was fifteen years ago. He is now a disappointed, frustrated and depressed man because he does not know how to get out of the hole. He wonders why and how things went wrong. His days are spent thinking about those glory days when he was rolling in money.

As an entrepreneur, one has to be able to swallow one's pride, accept the losses and get back on track as quickly as possible. If the last venture failed, quickly start again. As quickly as possible we must rebuild our appetite for risk. The faster we can disentangle ourselves from our previous failures, the quicker we should be able to launch our next successful venture.

Underestimating Or Overestimating Your Perceived Value

Just like an investor knows how to value an asset, an entrepreneur should know how to value himself, his company and his potential. The dot.com collapse has indeed taught us plenty. One of the greatest pitfalls of some founders is their inability to assess fairly the market value of their businesses.

Not knowing one's real value may have two effects. You may sell yourself short or you may ask for more. In either case once the deal or door is closed, there may be no recourse.

There is the story of two similar Internet companies launching their initial public offerings. One company refused refused to lower its valuation, saying, "We know how to value and we shall get the necessary funds, if not now, then later," not knowing that the window of opportunity was closing fast. The company that went ahead with the IPO was valued around $600 million dollars while the other is still seeking investors and is valued at only $10 million today.

The failure of the second company in not lowering its price resulted in disaster. It did not know its true market value and was unable to justify its greed. It did not know that once a company refuses to go IPO, the chances of getting a second chance is only one in twenty.

Likewise, an entrepreneur who underestimates his true market value may sell his equity is at a much lower price to get the much needed funds but if the value of the equity rises, he will feel short changed and resentful that he is doing more than the others but not reaping the same monetary reward. Figure 14.1 shows what happens when such an imbalance arises.

Subscribing To The "Build And They Shall Come" Theory

Call it vanity, call it greed, it was simply a case where they built and expected the customers, the public and markets to come. Many Internet ventures failed because they were solutions to problems that did not exist. Or they wanted to solve a problem that did not exist.

The greatest fools are those who say, "Build and they shall come." The crest of the bubble saw companies who were uncreative and truly un-Internet, churning out products copied from another or shuffling an old business model with an Internet twist.

They talked about replacing the old traditional medium of everything. They talked about the Internet and how it had brought about efficiency to the media, advertising, finance and banking businesses, and how the Internet is doubling its size.

They truly believe in "build and they shall come." They did not realize that nothing changes overnight, that we need the solution to get through today first.

This is music to Mr. VC. He asks, "Can you double the size of the market?"

Mr. founder replies, "Yes sir we can if we had the dough." Following is the story of a friend who has experienced it all. In 1998, John (not his real name), started a web solutions company. For the next two years, he was doing just fine. At times there were some operational issues such as cash flow but he was able to address them.

Then along came the dot.com wave. John figured if he could access venture capital he could also join the ranks of other founders who had converted success into fortune.

He approached venture capital companies and finally he got one which agreed to invest because John had demonstrated his passion, his vision and persistence and he had customers and revenues. The problem was that revenues were not sizable and the story was weak.

So the venture capital company promised him the money and outlined a development strategy for his business, giving him half of the capital now and the other half when the milestones were met.

John, in all eagerness, went out and executed all that was planned. He built operations in Hong Kong, Tokyo and London. They said to him, "Go for marketshare John. Do not look at revenues for now," and he obliged.

Then came the fateful day in March 2000 when the market broke. By now John has exhausted his reverses. He presented his report and achievements to the venture capital company but was told, "Sorry, John although you’ve built, they did not come. The market now needs to see revenues and not the potential for a successful exit. Although you have met your targets, the business is of little value to us now."

Heartbroken John broke the news to his team. He said, "Our success was due to our persistence. We failed because others did not share the same vision."

The Wrong Business Model

There is a saying in the industry, always bet on the right team and if the model is OK, it can be made right. But bet on the wrong model and even the greatest team of all will fail.

If one bets on the wrong model, seldom can it be better. It may be possible to fine tune, but that would require huge amounts of resources and efforts, the inconvenience of which is far greater than returns.

Many have failed because the model required a chicken and egg to be built at the same time; because they chose that path of free over fee, some failed as they fell into the first mover advantage trap.

Since the Internet is about information and it is information that we really trade in, we sell tools to access information or we sell data to others.

Many models on the Internet evolve around successfully building two sides of the marketplace at the same time. They build buyers and sellers simulation and the business-to-business exchange and aggregators fall into this space.

During the Internet boom many dots.com were looking forward to replicate the success of companies like Amazon and eBay which required them to build the supply side and the buy side at the same time. Many classic examples of recent failures include that of auctions, banner exchanges, advertising companies, loyalty reward sites, payment gateway providers and content delivery mechanisms.

They failed to understand that Amazon, eBay and Yahoo were filling gaps in the marketplace. The teams that had tried to make a success of their ventures then figured that they could make things work if they could partner those who had any one side covered.

This made utility companies partners of choice as they had the consumers. Approaching them made sense. Others tried to work with banks and giant telecommunications companies. Some dot.coms managed to convince them to open up their consumers to the new marketplace. The exchange or match seemed perfect now. They had got the buyers on one side and the sellers on the other. But neither buyers nor sellers saw any value in the exchange offerings. Thus a lot of time and resources went down the drain.

The business model was wrong from Day One. No matter how great and dynamic the team is, if we are in the wrong business, there is little we can do to turn it around.

Free and fee

In the early dot.com days, many businesses were able to quickly build up momentum, consumer bases and eyeballs to their sites by offering freebies.

Anything that was free would attract consumers and this made companies consider strategies to either sell out to another company for whom they were building these consumers and who require these consumers, or convert these consumers from the free subscription model to that of paying after some lag time.

The free model was in fashion in those days. Geocities, Hotmail and many others were built for alignment with the bigger boys, their exits were well planned and executed. The timing was ideal and having a huge consumer audience or web traffic (eyeballs) was hip with valuation experts and advertisers. For some their models worked like a drug, that is, just as a drug peddler gives away his offerings for free initially, once the consumer is hooked, the peddler will start charging money for it.

But the many others who came into the free game found out that this business model was very similar to that of a couple of decades ago. Then some businesses had attempted to give away printers but charged money for cartridges. Then, like now, the numbers simply did not add up and free was folly.

The Internet and it’s low cost of distribution provided very little value of anything that was free and in reality there was no guarantee that consumers could be converted into paying consumers for services that they themselves considered to be of little value. There is also no guarantee that once a company starts charging for its services or products, a new start-up will not offer the same for free.

The problem today is so bad that time and time again we hear entrepreneurs discussing where the revenue is going to come from. If someone says, "From the consumers", there is every reason to doubt the viability of the model, because it is a well-known fact that it is difficult to charge consumers.

Consumers do not expect to pay for services, content, product trials or software anymore. If they are asked to, they would simply look for a similar product which is free. Hotmail, the largest free Web-based e-mail provider, is still struggling to convert a percentage of its many free subscribers into paying for the service. Even if they are successful in doing so, the numbers will not simply not add up. The small numbers of paying subscribers cannot be expected to support the rest.

Then there is the cost of support, bandwidth and development. Customers today have become very unreasonable and will, if they have to, shout at the top of their voices if no support is given to them. Their expectations have risen and they expect businesses to provide their services or products for free and even offer support for it. Their rationale is simple, "If it was not for me, the consumer, would you be able to gain that footing, standing and valuation for your business?"

Established businesses may take the same stand as the consumers; since most start-ups lack credibility, they are at the mercy of established businesses. For instance, an established company that you, as a start-up, want to align with and offer your solutions to may not want to pay for you because it knows competition is fierce and that there are many like you in the same business. The established business thinks it is doing you a favor by teaming up with you because you will then have a better chance of survival and scalability.

The failure of the established business is its inability to understand that support, development and maintenance costs are huge. If you are not able to generate sufficient revenues, you will surely go down and with you their business and credibility will also follow.

It needs to be understood that venture capital funding is now relatively tight. The money that funded the early Internet spree is no more available. In the earlier days it was a well-known fact that every product bought from an online store was in some way or another subsidised by venture capital money.

The junkyards of innovations are laden today with business plans that spelt the names of freestuff.com and free this or that company.

We had to avoid this pitfall of thought, which says we could scale and build real revenues from free strategies. There may have been some winners but if you look closely, those founders who found fortune brought their bacon home from an entirely different strategy. Next time someone says free, look for that value and business strategy.

First mover advantage

Start-ups are known to put the words "first mover advantage" and "first in the world" in their business plans. First mover is a key advantage, as Yahoo, Hotmail and eBay, the first movers in their space, found out. Or were they?

Everyone loves to be first, because we remember those who are first. Ask anyone who was the first person to land on the moon and the answer is, "Neil Armstrong." But what about the person who landed ten seconds later? Seldom can we recall him.

Venture capitalists, angels and many others like to hear words like first mover, first in the world, new, innovative, patented technology and the like.

Technopreneurs on the other hand, have little choice but to sing these songs if they want to attract the capital they need for their ventures. It becomes a "catch-22" situation. There would be no capital available if this idea is not unique, cannot be patented or does not have the first mover advantage. On the other hand, they will fail to recognize that if this was indeed a new market, breaking new ground surely would not come so easy.

Many have also failed to realize that the real meaning behind the first mover advantage is first to try and fail. They did not realize that first movers usually are also the first ones to fail when problems arise. They failed to understand that nothing changes overnight and everything that is new requires an educational process and acceptance. This not only takes up resources but time to build.

They greatly overestimated the time it takes the marketplace to accept new innovations. This is one of the greatest pitfalls that funded the bubble. This assumption of the speed of acceptance has excited venture capitalists to pour massive amounts of capital into such deals.

From history we have seen that many patents are filled but only a few have any commercial value. Founders and investors thought that patents and technology innovation work competitive advantage and if they wanted proposals and solutions that work proprietary.

The truth is technology that has never given anyone any advantage. It gives one information on which competitive advantage could be built and a business with no competitors surely has little commercial viability.

From history we also have learned that new stuff seldom replaces the old. The new medium essentially carves out its own niches and eventually offers the old in a new, efficient and innovative medium. Because of the first mover's advantage fallacy, many founders persistently and falsely claimed that the old would become obsolete and the new would rule.

Investors are seldom the ones who benefit greatly from their inventions. The person who benefits most has been the one who took the invention, fine-turned it and made it a success. For instance, the creator of Coca-Cola is Dr. John Pemberton. The story is that Asa Candler purchased the recipe of Coca-Cola for US $2,300. Today, of course, the Coca-Cola brand is known the world over, and Coke itself is about as close to a US national symbol as are hotdogs and baseball.

Many businesses blossom and then wither. Improve your odds of survival by avoiding the potential pitfalls discussed in the chapter.

Chapter 14 Potential Pitfalls >>>

Technopreneurship Development - A Role for Society in Technopreneurship Development, a chapter written in 2002, explains the creative destructive forces at work in practically every aspect of human life and the reasoning for the massive confusion, leading up to revolutions, lack of employment opportunities and governments fiscal deficits. Technology is usually blamed for making the world a smaller place, the writing was on the wall since the late nineties, this chapter refreshes our memories.